Swen Lorenz

The organiser

Meet Swen Lorenz, the face behind Weird Shit Investing.

With over 30 years of experience in investing, Swen has a knack of finding exciting investment opportunities in unexpected places. His website, Undervalued-Shares.com, include extensive, investigative reports which give investors plenty of inspiration and ideas to work with.

Swen Lorenz

The organiser

Meet Swen Lorenz, the face behind Weird Shit Investing.

With over 30 years of experience in investing, Swen has a knack of finding exciting investment opportunities in unexpected places. His website, Undervalued-Shares.com, include extensive, investigative reports which give investors plenty of inspiration and ideas to work with.

Example articles

Check out some of Swen’s articles that fit the Weird Shit Investing concept:

Panthera Resources – multi-bagger legal claim?

London-listed Panthera Resources just closed a heavily oversubscribed placement. Why the demand for a seemingly defunct micro-company?

Human bones – an emerging asset class?

Prices for dinosaur skeletons have gone vertical. Will rare human bones experience a similar boom?

Energy Transition Minerals – the crazy Greenland micro-cap

Australian micro-cap Energy Transition Minerals could hold the key for a US-Greenland-Denmark deal – as crazy as it may sound.

Guyana and the mystery of the largest ranch in the Americas

Guyana could become the world’s richest country. Besides oil and gas stocks, it also entails an unknown, century-old land company.

Radium – the rare metal worth 120,000x the price of gold

Demand from Big Pharma has turned radium into the world’s hottest commodity. A remarkable investment opportunity awaits.

Helios Underwriting – down the rabbit hole of Lloyd’s of London’s insurance market

Little-known Helios Underwriting is a clever back-door entry to the lucrative Lloyd’s insurance market.

Pinelawn Cemetery – making a fortune from “land share certificates”

Pinelawn Cemetery is the US’ only remaining cemetery with tradable land shares, and you can invest through the stock market!

Venezuela – a multi-bagger recovery play?

Venezuela has more oil than Saudi Arabia, but suffered the worst economic collapse in modern history. Can private investors benefit from its recovery?

Société de la Tour Eiffel – a lesson for idea generation

Can you buy a stake in the famous Eiffel Tower? The Société de la Tour Eiffel is a stock market oddity – and one that provides a useful lesson.

Lloyd’s of London – a secular new theme?

Insurance market Lloyd’s of London wants to double in size. How can private investors participate in the opportunity?

Polymetal: how to buy Russian gold mines for free

London-listed Polymetal gets you a stake in Russian gold mining for the proverbial song. Crisis investing at its best!

Ukrainian agriculture stocks – land for 15 dollars an acre?

There are six Ukrainian agriculture companies that you can buy shares of, even now. Are they the ultimate crisis bargain?

Revisiting the Amazon of Iran – a final chance to get in?

Pomegranate Investment and Digikala proved a hit with my readers. Here’s another opportunity to subscribe to newly issued shares.

Thungela – 350% quick profit from green insanity

Anglo American spun off its thermal coal division. “Green” funds were forced sellers, and rational buyers made a fortune. A new investment trend beckons – get in on it!

Oversupply of Wimbledon Debentures – your opportunity to invest?

Yes, you can invest in the Wimbledon tennis courts. The organiser has issued a little-known, quirky security that trades through a London brokerage firm.

Riches among ruins (part 2): my 5,000% investment adventure in war-torn Iraq

You know an investment thesis is controversial when most publishers refuse to even let you write about it. Not surprisingly for such an ultra-contrarian bet, it was also amazingly lucrative!

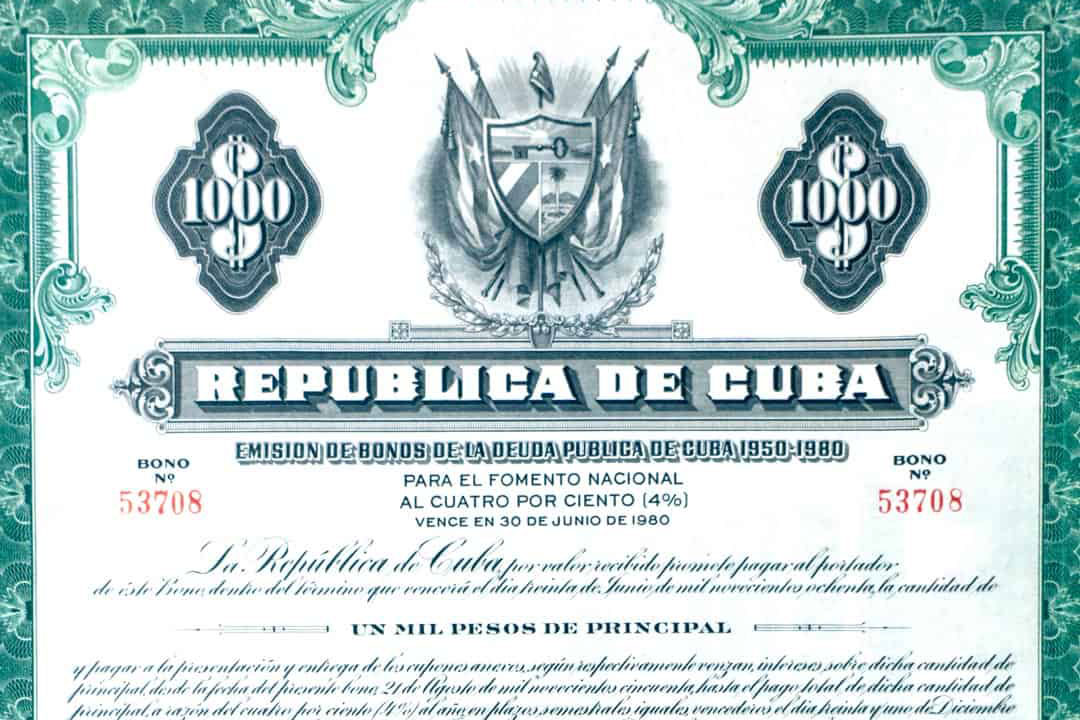

How to make a fortune off defaulted debt

An amazing history of defaulted German bonds from 1930, czarist Russian bonds, and the upcoming opportunity with Cuban bonds.

Finding opportunities (and adventure) among unlisted companies

Unlisted companies often offer the best-ever investment opportunities – provided you know how and where to find them!

The Economist: a good investment?

It’s little-known, but The Economist has over 1,000 shareholders. It’s akin to an exclusive club, which rather wants to keep you out. Will you be able to buy stock regardless – and could a proper IPO beckon?

Secret Californian company with billions in water rights?

This family-controlled but publicly traded company holds private property rights to 1% of the entire water that is produced in California each year.

Lebanon’s distressed debt opportunity

Distressed Lebanese bonds could easily double or triple in value. Is it time to start building a position?